The phrase denotes a specific financial entity. It describes a firm likely involved in private investments, potentially focusing on acquiring or managing stakes in companies. Such an organization typically pools capital from various investors to deploy it strategically across different businesses, aiming for long-term growth and returns.

Organizations of this nature play a crucial role in the financial ecosystem. They provide vital capital to businesses that may not have access to traditional funding sources, fostering innovation and expansion. Investment from these entities can propel companies to new heights, generate employment opportunities, and stimulate economic activity. Their existence dates back to the rise of institutional investment and the need for sophisticated capital management.

The operational characteristics and investment strategies of such firms often vary widely. Understanding these specific approaches is vital for businesses seeking funding, investors evaluating potential opportunities, and anyone aiming to gauge the impact of private capital on the broader economy. Further analysis will delve into the characteristics and impact of related financial players.

Key Considerations for Stakeholders

Navigating the landscape of private capital requires careful consideration. The following points offer guidance for entities interacting with firms like the one identified by the key phrase.

Tip 1: Conduct Thorough Due Diligence: Before engaging in any financial transaction, a comprehensive investigation of the firm’s track record, investment strategy, and management team is paramount. This includes verifying their regulatory compliance and historical performance.

Tip 2: Understand Investment Objectives: Alignment of goals is essential. Businesses seeking investment should ensure their long-term vision corresponds with the firm’s investment horizon and desired return profile.

Tip 3: Assess Operational Expertise: Beyond capital, consider the value-added services offered. A firm’s operational experience and industry network can significantly impact a portfolio company’s success.

Tip 4: Evaluate Risk Tolerance: Private equity investments inherently involve risk. It’s crucial to understand the firm’s appetite for risk and how it manages potential downsides in its portfolio.

Tip 5: Scrutinize Legal Agreements: Investment terms, governance rights, and exit strategies should be meticulously reviewed and negotiated to ensure mutual understanding and protection of interests.

Tip 6: Monitor Performance Regularly: Ongoing tracking of the investment’s progress and performance is critical. Maintain open communication with the firm and demand regular reporting on key performance indicators.

Tip 7: Consider Exit Options: Understanding potential exit strategies from the outset is crucial for both investors and investees. This involves considering factors like market conditions, company performance, and potential acquirers.

These considerations are vital for maximizing the benefits and mitigating the risks associated with private capital engagements. A well-informed approach can lead to successful partnerships and long-term value creation.

Further discussion will focus on specific investment sectors and emerging trends within the private capital market.

1. Private Investment

Private investment forms the bedrock of activity for entities like the firm under discussion. It represents the inflow of capital that fuels their operations, enabling acquisitions, expansions, and strategic initiatives. The effectiveness with which these investments are managed directly impacts the firm’s overall performance and its ability to generate returns for its stakeholders.

- Capital Sourcing

This facet encompasses the methods employed to attract investment funds. These may include private placements with high-net-worth individuals, institutional investors, or sovereign wealth funds. The ability to secure diverse and substantial capital sources dictates the scale and scope of potential investments.

- Due Diligence and Risk Assessment

Before deploying capital, a rigorous evaluation of potential targets is essential. This involves scrutinizing financial statements, assessing market conditions, and identifying potential risks associated with the investment. Thorough due diligence minimizes the likelihood of adverse outcomes and ensures alignment with the firm’s investment strategy.

- Investment Strategy Alignment

Private investment is not merely about accumulating capital; it’s about deploying it strategically. A well-defined investment strategy, tailored to the firm’s expertise and market opportunities, is critical for long-term success. This strategy guides the selection of investment targets and ensures a cohesive portfolio that maximizes returns.

- Value Creation and Operational Improvement

A key aspect of private investment is the proactive enhancement of acquired companies. This can involve operational improvements, strategic repositioning, or expansion into new markets. The ability to drive value creation within portfolio companies is a significant differentiator and a driver of superior returns.

In essence, private investment is the engine that drives the operational capabilities of the firm. By understanding the nuances of capital sourcing, due diligence, strategy alignment, and value creation, one can better appreciate the firm’s impact on the broader economic landscape and its role in fostering growth within its portfolio companies. The firm’s success hinges on its proficiency in navigating these elements of private investment effectively and strategically.

2. Capital Allocation

Capital allocation is a central function within an entity like the one described by the provided phrase. It represents the strategic deployment of financial resources across various investment opportunities, influencing profitability and long-term growth. In this context, the effectiveness of capital allocation directly determines the return on investment and the sustainability of the firm’s business model. A disciplined approach to capital allocation is essential for achieving targeted returns and mitigating risks. An ill-conceived allocation strategy can lead to diminished returns and a weakened financial position. Therefore, the firm is likely structured to optimize these strategic decisions, with experienced management teams and sophisticated analytical tools facilitating informed capital allocation.

The process encompasses various steps, including opportunity assessment, risk evaluation, and portfolio construction. Opportunities are continuously evaluated based on market trends, industry dynamics, and specific company performance. Rigorous risk assessment is critical to mitigate potential losses and preserve capital. Portfolio construction ensures diversification and balance between high-growth and lower-risk investments. As an example, a substantial investment in a promising technology startup may be balanced by investments in more established, cash-flowing businesses. The allocation decisions will likely affect the future growth and financial stability of a company and the fund itself.

Understanding the principles and practices of capital allocation as employed by this entity is practically significant for investors, potential portfolio companies, and industry observers. The choices made regarding resource deployment reflect the firm’s strategic vision and risk appetite. A careful analysis of capital allocation trends can offer insights into the firm’s investment priorities and potential future performance. While the specific details of allocation decisions may remain proprietary, a general understanding of their underlying philosophy can enhance transparency and inform decision-making for all stakeholders.

3. Strategic Acquisitions

Strategic acquisitions represent a critical avenue through which firms resembling the one described by the phrase deploy capital and achieve their investment objectives. These acquisitions are not merely about increasing portfolio size; they are calculated moves designed to enhance value, expand market presence, or integrate complementary businesses, thus directly impacting the growth trajectory and financial performance of the investing firm and its portfolio companies.

- Target Identification and Valuation

The process begins with identifying suitable acquisition targets that align with the firm’s investment thesis and strategic objectives. Rigorous valuation methodologies, including discounted cash flow analysis and comparable transaction analysis, are employed to determine the fair market value of potential targets. This ensures that acquisitions are made at prices that maximize potential returns and minimize financial risk. For instance, a firm may target a smaller competitor in a fragmented market to consolidate its position and gain market share.

- Deal Structuring and Negotiation

Deal structuring involves crafting the terms of the acquisition, including purchase price, payment method (cash, stock, or a combination thereof), and any contingent consideration arrangements (e.g., earn-outs). Skilled negotiation is essential to secure favorable terms for the investing firm, while also addressing the concerns of the target company’s stakeholders. A complex deal might involve securing regulatory approvals and addressing potential antitrust concerns to ensure a successful closing.

- Post-Acquisition Integration

The success of a strategic acquisition hinges on effective post-acquisition integration. This involves seamlessly integrating the acquired company’s operations, systems, and personnel into the acquiring firm’s existing infrastructure. A well-executed integration plan minimizes disruption, unlocks synergies, and maximizes the value of the combined entity. Failure to integrate effectively can lead to lost opportunities and diminished returns.

- Value Creation and Performance Enhancement

Strategic acquisitions are ultimately aimed at creating value for the investing firm and its investors. This may involve improving the acquired company’s operational efficiency, expanding its product or service offerings, or penetrating new markets. The firm’s expertise and resources are leveraged to enhance the acquired company’s performance and generate attractive returns. For example, a firm might streamline the supply chain of an acquired company, reducing costs and improving profitability.

These facets illustrate how strategic acquisitions serve as a cornerstone of the firm’s overall investment strategy. By carefully identifying, structuring, integrating, and enhancing acquired businesses, the firm can generate significant value and achieve its long-term financial goals. The firm’s capabilities in these areas directly influence its reputation and its ability to attract future investment opportunities, highlighting the importance of strategic acquisitions in its overall success.

4. Portfolio Management

Portfolio management constitutes a central pillar of any organization operating under a private equity model. For an entity like the one referenced, its success is inextricably linked to the efficacy of its portfolio management strategies. The act of acquiring companies or stakes in existing businesses sets the stage, but it is the subsequent management and strategic oversight that determine the ultimate return on investment. Portfolio management is not a passive endeavor; it requires active engagement with each company within the portfolio to identify opportunities for improvement, address challenges, and drive growth. Example scenarios could involve streamlining operations, expanding into new markets, or implementing technological upgrades. Effective portfolio management aims to maximize the value of each individual asset while mitigating overall risk across the entire portfolio.

The firm likely employs a team of experienced professionals dedicated to overseeing its investments. These individuals work closely with the management teams of portfolio companies, providing guidance, resources, and strategic direction. Furthermore, performance metrics are continuously monitored, and adjustments are made as needed to ensure that each company is on track to meet its goals. For example, a portfolio manager might identify a decline in sales at one company and work with its management team to implement a new marketing strategy or adjust pricing models. Active engagement with each portfolio company ensures strategic alignment and optimized operations.

In summary, portfolio management is not merely a supporting function but a core driver of success for firms operating in the private equity space. Diligent oversight, strategic interventions, and a focus on value creation are essential components of effective portfolio management. While acquisitions provide the initial opportunity, it is the subsequent management and enhancement of those investments that ultimately determine the profitability and sustainability of the business. Understanding this connection is essential for all stakeholders seeking to evaluate the performance and potential of such investment firms.

5. Financial Growth

For an entity operating as a private investment firm, sustained financial growth is not merely a desirable outcome but a critical imperative for long-term sustainability and success. The financial health and expansion of such firms, which may invest in or acquire other companies, are inextricably linked to their ability to generate consistent returns for their investors, attract new capital, and maintain a competitive edge within the investment landscape. Without demonstrable financial growth, these organizations risk erosion of investor confidence, decreased access to funding, and a diminished capacity to capitalize on emerging market opportunities. A stagnant financial position can also attract scrutiny from regulators and potentially limit future investment endeavors.

The achievement of financial growth within entities similar to Chimney Rock Equity is often dependent on a multifaceted approach. These actions might include but not limited to the strategic allocation of capital across a diversified portfolio of investments, the implementation of operational efficiencies within portfolio companies, and the successful execution of exit strategies such as initial public offerings (IPOs) or sales to strategic acquirers. These firms may also choose to expand into new markets or asset classes to diversify revenue streams and capitalize on emerging trends. For example, a company in the portfolio might experience rapid growth and be sold to a larger company resulting in a substantial return. In each of these scenarios, the ability to drive financial growth is directly related to the firms ability to make sound investment decisions and actively manage their portfolio companies.

In conclusion, financial growth is both a performance metric and an operational goal for private investment entities. It reflects the firm’s ability to generate value for its investors and serves as a foundation for future investment opportunities. Successful firms prioritize strategies that drive sustainable financial growth, including effective capital allocation, operational improvements, and strategic exits. Maintaining a keen focus on these elements is essential for sustaining long-term success and maintaining a competitive edge within the dynamic private investment market. Any failure to understand financial growth will ultimately put its reputation at risk.

6. Return Generation

Return generation is the ultimate measure of success for an entity operating within the private equity sphere. The ability to consistently deliver attractive returns to investors is the defining characteristic that dictates its longevity and influence. This underscores the crucial role of effective investment strategies and operational execution in driving financial performance.

- Investment Selection and Due Diligence

The foundation of return generation lies in identifying and selecting promising investment opportunities. Thorough due diligence is essential to assess the potential risks and rewards associated with each target. A rigorous evaluation of financial statements, market conditions, and competitive landscapes is paramount to mitigating risk and maximizing potential returns. For example, detailed analysis of a target company’s management team, customer base, and intellectual property portfolio can reveal hidden strengths or weaknesses that significantly impact its future performance.

- Operational Value Creation

Beyond the initial investment, active engagement in enhancing the operational performance of portfolio companies is crucial. This involves implementing best practices, streamlining processes, and optimizing resource allocation. Experienced operational teams work closely with portfolio company management to identify areas for improvement and drive value creation. For instance, implementing lean manufacturing principles can reduce costs and improve efficiency, while expanding into new markets can drive revenue growth.

- Strategic Exits and Monetization

The culmination of the investment cycle is the strategic exit, which involves realizing the value created during the holding period. Common exit strategies include initial public offerings (IPOs), sales to strategic acquirers, and secondary sales to other private equity firms. The timing and execution of the exit are critical to maximizing returns. A well-timed IPO, for example, can generate significant gains if market conditions are favorable, while a strategic sale can unlock synergies and command a premium valuation.

- Risk Management and Mitigation

Effective risk management is integral to return generation. Identifying and mitigating potential risks, such as macroeconomic downturns, industry disruptions, or operational challenges, is essential to preserving capital and protecting returns. Diversification across industries and geographies can help to mitigate systemic risk, while proactive monitoring of portfolio company performance can identify and address potential problems before they escalate.

These interconnected aspects are the core components of any return generation strategy employed by a private equity firm. The interplay between shrewd investment decisions, effective operational enhancements, strategic exits, and rigorous risk management determines the ultimate success in delivering returns to investors and sustaining long-term growth. A failure in any of these areas could jeopardize the overall return profile and damage the firms reputation. These efforts make Chimney Rock Equity into a successful institution.

Frequently Asked Questions

The following questions address common inquiries regarding private investment firms, specifically those similar to the entity referenced by the key phrase. The aim is to provide clear, concise answers to enhance understanding of their operations and impact.

Question 1: What is the typical investment horizon for an organization of this type?

Investment timelines generally span three to seven years, allowing sufficient time to implement strategic improvements and realize value appreciation within portfolio companies.

Question 2: How does a private investment firm create value within its portfolio companies?

Value creation strategies encompass operational improvements, strategic repositioning, revenue enhancement, and cost optimization, often leveraging the firm’s expertise and network.

Question 3: What are the key factors considered when evaluating potential investment opportunities?

Critical factors include the target company’s financial performance, market position, management team, growth potential, and competitive landscape, all subject to rigorous due diligence.

Question 4: What are common exit strategies employed by private investment firms?

Typical exit routes involve initial public offerings (IPOs), sales to strategic acquirers, secondary buyouts to other private equity firms, and recapitalizations to return capital to investors.

Question 5: How do these firms manage risk across their investment portfolios?

Risk mitigation strategies include diversification across industries and geographies, thorough due diligence, active monitoring of portfolio company performance, and hedging against macroeconomic risks.

Question 6: What is the role of leverage in a private investment firm’s strategy?

Leverage, or debt financing, can amplify returns but also increases financial risk. Prudent use of leverage is carefully balanced against the potential benefits and the overall risk profile of the investment.

These answers offer a fundamental understanding of the key aspects related to private investment firms. Gaining further insights into the specific nuances of their operations and investment strategies requires a deeper analysis of individual organizations and market conditions.

The subsequent section will explore the broader economic impact of these investment entities and their role in fostering growth and innovation.

Conclusion

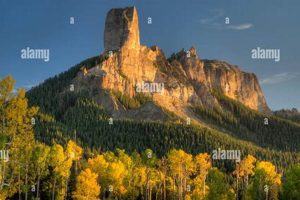

The preceding analysis has explored the characteristics and operational dynamics of a private investment firm, using the phrase “chimney rock equity” as a representative example. Key facets such as private investment sourcing, capital allocation strategies, strategic acquisitions, portfolio management practices, and the pursuit of financial growth and return generation have been examined. These elements collectively define the operational landscape and strategic imperatives of such entities.

Understanding the functions and impact of organizations resembling “chimney rock equity” is essential for investors, businesses seeking capital, and those interested in the broader financial ecosystem. These firms play a significant role in shaping market dynamics, driving innovation, and influencing economic growth. Continued scrutiny and analysis of their activities will be crucial for fostering transparency and promoting responsible investment practices. Further research into specific strategies and performance metrics is encouraged to gain a more granular understanding of this sector.